Kemper Life Insurance is a life insurance company that offers a variety of life insurance products to its customers. These products include term life insurance, whole life insurance, and universal life insurance.

— Term life insurance is a type of life insurance that provides coverage for a specific period of time, such as 10, 20, or 30 years. The policy pays a benefit to the designated beneficiary if the policyholder dies within the term of the policy. Term life insurance is typically the most affordable type of life insurance and is often used to provide financial protection for a specific need, such as paying off a mortgage or providing income for a spouse and children.

— Whole life insurance is a type of permanent life insurance that provides coverage for the policyholder’s entire life. In addition to providing a death benefit, whole life insurance also includes a savings component, which allows policyholders to build cash value that they can borrow against or withdraw in the future. Whole life insurance is generally more expensive than term life insurance, but it can provide a more comprehensive financial planning tool for policyholders.

— Universal life insurance is a type of permanent life insurance that offers flexibility in terms of premiums and death benefits. Policyholders can choose to pay higher or lower premiums, and the death benefit can be adjusted up or down as well. Universal life insurance also includes a savings component, which allows policyholders to build cash value that can be used for a variety of purposes.

Features of Kemper Life Insurance

- Kemper Life Insurance has a strong financial rating and a long history of providing quality life insurance products to its customers. If you are considering purchasing a life insurance policy, it may be worth considering Kemper Life Insurance as one of your options.

- In addition to offering traditional life insurance products, Kemper Life Insurance also offers a variety of riders and options that policyholders can add to their policies to customize their coverage. These riders can provide additional benefits such as accidental death coverage, long-term care coverage, and disability income protection.

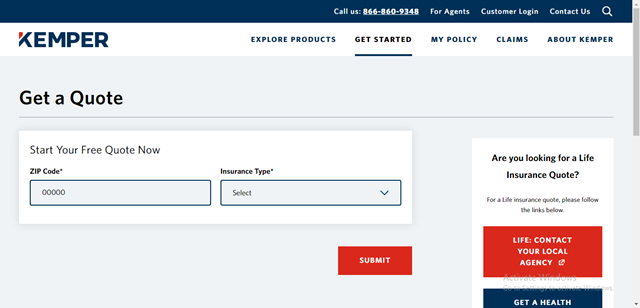

- Kemper Life Insurance is known for its commitment to customer service and has a reputation for making the process of purchasing a life insurance policy straightforward and easy to understand. The company has a team of knowledgeable and experienced agents who can help you find the right policy to meet your needs and budget.

Benefits of Kemper Life Insurance

- One of the advantages of working with Kemper Life Insurance is that the company has a wide network of financial advisors and agents who can assist you in finding the right policy and answer any questions you may have.

- The company also offers online tools and resources to help you understand the different types of life insurance and how they can benefit you and your loved ones.

- In summary, The Company is a well-respected and reliable provider of life insurance products. If you are in the market for a life insurance policy, it is worth considering Kemper Life Insurance as an option.

- Another advantage of choosing Kemper Life Insurance is the company’s commitment to sustainability. Kemper is a member of the United Nations Global Compact, which is a voluntary initiative that encourages businesses to adopt sustainable and socially responsible policies. The company also has a sustainability program in place that focuses on reducing its environmental impact and supporting the communities in which it operates.

- In addition to traditional life insurance products, Kemper Life Insurance also offers annuities, which are financial products that provide a stream of income over a specific period of time. Annuities can be a good option for people who are nearing retirement or looking for a reliable source of income in retirement. Kemper offers a range of annuity products, including fixed annuities, variable annuities, and indexed annuities.

In conclusion, Kemper Life Insurance is a reputable and reliable provider of life insurance and annuity products. The company has a strong financial rating, a commitment to customer service, and a focus on sustainability. If you are considering purchasing a life insurance policy or annuity, Kemper Life Insurance is worth considering as one of your options.

Overview of the Company

It is worth noting that, like any financial product, life insurance and annuities have their own set of risks and limitations. It is important to carefully consider your financial goals and needs before choosing a policy or annuity, and to carefully review the terms and conditions of any policy or annuity you are considering.

It is also important to consider the financial stability of the insurance company you choose. Kemper Life Insurance has a strong financial rating and a long history of stability, but it is always a good idea to research the financial strength of any insurance company you are considering. This can help ensure that the company will be able to fulfill its financial obligations to you and your loved ones.

If you have any questions or concerns about Kemper Life Insurance or any other life insurance or annuity provider, it is a good idea to speak with a financial advisor or professional. They can help you understand the different options available and assist you in making an informed decision.

Always Visit Cakeas.com for quality information and update about Insurance and Scholarships