Harley-Davidson is a brand of motorcycle that is known for its iconic design and powerful engines. If you own a Harley-Davidson motorcycle, it is important to have the proper insurance coverage to protect your investment and ensure that you are financially prepared in the event of an accident or other unforeseen event.

Types Of Insurance Coverage in Harley Davidson Insurance

There are several types of insurance coverage available for Harley-Davidson motorcycles, including:

Liability insurance:

This type of coverage protects you in the event that you are found to be at fault in an accident and are sued by the other party. It covers damages and injuries to other people and their property.

Collision insurance:

This type of coverage pays for damages to your motorcycle if you are involved in an accident with another vehicle or object.

Comprehensive insurance:

This type of coverage pays for damages to your motorcycle that are not caused by a collision, such as theft or weather-related damages.

Medical payments coverage:

This type of coverage pays for medical expenses and lost wages if you or a passenger are injured in an accident.

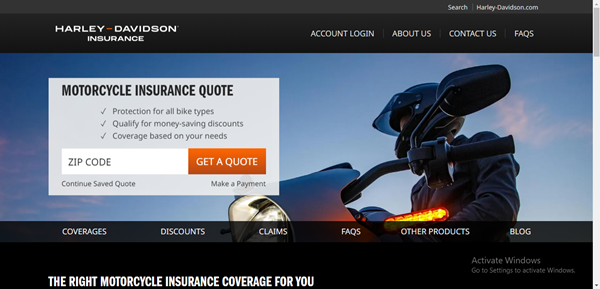

When shopping for Harley-Davidson insurance, it is important to compare quotes from multiple insurance companies to find the best coverage at the most affordable price.

You should also consider any additional coverages that may be relevant to you, such as roadside assistance or coverage for custom parts and accessories.

Other Harley-Davidson Motorcycle Insurance Coverage Options

In addition to the types of coverage mentioned above, there are also a few other factors to consider when shopping for Harley-Davidson insurance:

READ ALSO:

Andrew Fairlie Scholarship Application

Prince Philip Scholarship Programme

Deductibles:

A deductible is the amount of money you are required to pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, but it is important to choose a deductible that you can afford in the event of a claim.

Premiums:

Premiums are the monthly or annual payments you make to maintain your insurance coverage. The cost of your premiums will depend on a variety of factors, including the type and amount of coverage you choose, your age, the type of motorcycle you own, and your driving history.

Discounts:

Many insurance companies offer discounts for things like safe driving, taking a motorcycle safety course, or bundling multiple types of insurance coverage. Be sure to ask about any available discounts when shopping for Harley-Davidson insurance.

It is also a good idea to review your insurance coverage on a regular basis to ensure that it still meets your needs. As your motorcycle and circumstances change, your insurance needs may change as well.

Insurance limits:

Insurance limits refer to the maximum amount that an insurance policy will pay out in the event of a claim. It is important to choose limits that are high enough to fully protect your motorcycle and financial interests in the event of a catastrophic loss.

Coverage for custom parts and accessories:

If you have made significant modifications to your Harley-Davidson motorcycle, you may need to purchase additional coverage to protect those custom parts and accessories. Be sure to discuss any modifications with your insurance agent to ensure that you have the appropriate coverage.

Coverage for riding gear:

Some insurance policies may include coverage for riding gear, such as helmets, gloves, and protective clothing. If your policy does not include this coverage, you may want to consider purchasing it separately to ensure that you are protected in the event of an accident.

Coverage for roadside assistance:

Roadside assistance coverage can be a valuable addition to your Harley-Davidson insurance policy, as it can provide assistance if you experience a breakdown or other issue while on the road. This may include towing, battery jump-starts, and tire changes.

Overall, it is important to carefully consider your insurance needs when shopping for coverage for your Harley-Davidson motorcycle. By understanding the different types of coverage available and choosing the right policy for your specific needs, you can ensure that you and your motorcycle are fully protected.

In addition to the types of coverage mentioned above, there are a few other considerations to keep in mind when shopping for Harley-Davidson insurance:

Payment options:

Many insurance companies offer flexible payment options, such as monthly or annual payments, to make it easier for you to manage your insurance expenses. Be sure to ask about the payment options available when shopping for coverage.

Policy terms:

Insurance policies generally have terms that dictate how long the coverage is in effect and any exclusions or limitations that apply. It is important to carefully review the terms of your policy to understand what is and is not covered.

Claims process:

In the event that you need to file a claim with your insurance company, it is important to understand the process and what steps you need to take. Ask your insurance agent about the claims process and what documentation you will need to provide in order to file a claim.

Insurance company reputation: It is important to choose an insurance company that has a good reputation for customer service and claims handling. Research the insurance company’s ratings and reviews before selecting a policy.

By carefully considering these factors when shopping for Harley-Davidson insurance, you can ensure that you have the coverage you need to protect your motorcycle and financial interests.

One additional factor to consider when shopping for Harley-Davidson insurance is the availability of additional endorsements or riders. These are additional coverage options that can be added to your insurance policy for an additional cost. Some examples of endorsements that may be available for Harley-Davidson insurance include:

Increased coverage for custom parts and accessories: If you have made significant modifications to your Harley-Davidson motorcycle, you may want to consider increasing the coverage for custom parts and accessories beyond what is included in your basic policy.

Coverage for custom paint or graphics: If you have added custom paint or graphics to your Harley-Davidson motorcycle, you may want to consider purchasing coverage to protect those custom features.

Coverage for personal property: Some insurance policies may include coverage for personal property that is lost, damaged, or stolen while in or on your motorcycle. This may include items such as your wallet, phone, or camera.

Coverage for rental motorcycles: If you plan to rent a motorcycle while traveling, you may want to consider purchasing coverage to protect yourself in the event of an accident or other unforeseen event.

By considering these endorsements and riders, you can ensure that you have the coverage you need to fully protect your Harley-Davidson motorcycle and your personal property. Be sure to discuss any endorsements or riders that you are interested in with your insurance agent to determine the availability and cost of these additional coverage options.

Harley-Davidson Insurance Vehicle Coverage Options

Harley Davidson provides insurance for a whole lot of Harley Davidson motorcycles, which includes the following

- Cruiser

- CVO

- Sportster

- Softail

- Autocycle

- Standard

- Dyna

- Sport touring

- V-Rod

- Trike

- Scooter/moped

- Touring

- Street Rod

- S Series

- Sport bike

- Dual purpose

There are also Coverage options available for any accessories or modifications you’ve made to your motorcycle.

Pros and Cons of Harley Davidson Insurance

Pros:

- A wide range of coverage options are available.

- Availability of numerous discounts; special discounts available only to Harley-Davidson owners

Cons:

- More costly than competitors

- It is not possible to combine auto and motorcycle insurance.

Click Here to visit the official website and purchase your insurance policy

Check out:

Millfield Scholarship for US Students